For nearly 90 years, a widespread misconception has shaped how Americans view Social Security. Many believe that their payroll taxes are saved in a trust fund, to be drawn down when they retire. But in reality, Social Security has never operated as a savings system. Instead, it functions as an income transfer program, where the taxes collected from today’s workers immediately fund the benefits for current retirees. This misconception about how Social Security works continues to distort the debate around its future.

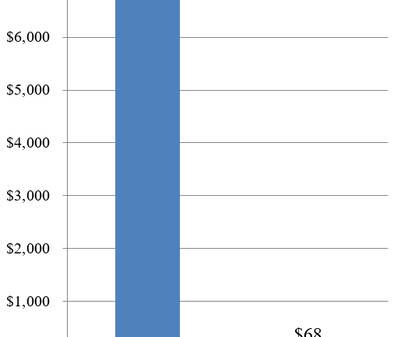

Social Security was designed to transfer income, not to save it. The first recipient of Social Security, Ida May Fuller, perfectly illustrates this. Fuller paid less than $25 in Social Security taxes (about $500 today) before retiring in 1940. Her first check nearly matched what she had paid in, and over the next 35 years, she collected $23,000 in benefits—nearly 1,000 times what she contributed (or roughly $500,000 in today’s terms). This arrangement worked out great for earlier generations, but today’s workers aren’t so lucky. They are paying high taxes for a benefit that’s far lower than what they could earn if they invested the money in a balanced portfolio of stocks and bonds instead.

These issues are echoed in my new Cato paper, The Social Security Trust Fund Myth, which was published on November 13. The paper offers helpful analogies to explain how Social Security is financed, from illustrating its accounting realities in terms of a household budget to explaining the difference between real savings and IOUs and why IOUs in an intragovernmental “trust fund” provide no actual funding mechanism for paying future benefits.

The political narrative that fuels the trust fund myth has persisted since Social Security’s inception. In the 1930s, the idea of government assistance was unpopular, and policymakers needed a way to sell Social Security to a skeptical public. Positioning it as an “earned” benefit convinced Americans that they had a personal stake in the program. But in truth, it was always a government transfer program. The notion that people are simply getting back what they paid in makes it politically difficult to reduce benefits. Even slowing the growth of benefits is considered taboo, despite the program providing higher benefits in absolute terms (after factoring in inflation) to successive cohorts of beneficiaries, because initial benefits are boosted by economy-wide wage gains.

This misunderstanding is dangerous. Social Security is unsustainable as designed, and it faces severe financial challenges. The growing number of retirees, combined with lower fertility rates, means there are fewer workers to support those retirees. In fact, the government is expected to borrow $4.1 trillion by 2033 just to keep up with benefit payments. Waiting until the so-called trust fund runs out in nine years will only lead to more drastic adjustments, threatening the financial security of both retirees and workers.

What’s needed is a shift in the social contract—a fairer system that avoids excessively taxing younger, often poorer workers to fund extended retirements for older generations, who on average are much wealthier. Reforming Social Security to focus benefits on keeping seniors out of poverty, reducing benefits for higher earners, and slowing the growth in future benefits is crucial. This approach would relieve younger workers from higher taxes and allow them to save more for their retirements through personal accounts that they own and control.

Social Security’s Ponzi-like structure—where current contributions fund current benefits—has always been its flaw. And unlike Ponzi’s scheme, which was illegal, Social Security’s issues are legal and transparent, rooted in flawed program design and changing demographics. Addressing this sooner rather than later is the only way to avoid severe consequences for future generations that are confronted with the triple threats of an unfunded Social Security system and the specter of higher taxes and inflation.