This summer witnessed a major new plot twist in the Bitcoin saga. Originally conceived of as a revolutionary grass-roots alternative to established fiat currencies, including the US dollar, the twist has Bitcoin serving not to counter but to fortify the US dollar’s status as the world’s most popular exchange medium.

Although it has somewhat earlier roots, the new vision for Bitcoin gained prominence at this July’s Bitcoin 2024 conference in Nashville, where no fewer than three speakers, including then-presidential candidates Robert F. Kennedy, Jr. and Donald Trump, made proposals based on it.

Like Goldilocks’ Three Bears, the proposals came in three sizes. Trump’s, the most modest, would have the federal government use all of the 210,000 Bitcoins it already possesses—most of them seized by law enforcement agencies—to form “the core” of a “Strategic National Bitcoin Stockpile” that would supposedly “benefit all Americans.”

Kennedy’s plan—the papa bear—would start with Trump’s core and add 550 Bitcoin to it daily until the Treasury held at least four million Bitcoin, or more than a fifth of today’s outstanding stock. According to Kennedy, his plan, which would equip the Treasury with Bitcoin worth more, at today’s market prices, than its gold reserves, would put the United States “at a position of dominance that no other country will be able to usurp.”

The mama bear, finally, was unveiled by Senator Cynthia Lummis (R‑WY) just after Trump’s keynote speech. It would have the US Treasury establish a “Bitcoin Strategic Reserve” consisting of one million coins purchased over five years. Unlike the other proposals, Lummis’s has taken shape in actual legislation, The BITCOIN Act of 2024 (the acronym stands for “Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide”) introduced by Lummis a few days after the Nashville event. The proposed reserve’s purposes include “strengthening the position of the United States dollar in the global financial system.”

Were the idea of creating an official US Bitcoin stockpile only popular with politicians, it might be brushed off as a cynical attempt to tap Bitcoin’s popularity for votes. But to judge not just from the rounds of applause the three proposals garnered in Nashville, but from commentary afterward, whether or not Satoshi Nakamoto himself would have approved of them, many Bitcoin fans are convinced that the proposed Bitcoin stockpiles really will do the US dollar, and the US economy as a whole, a lot of good.

Politicians are not the only ones calling for the U.S. government to jump on the Bitcoin bandwagon. In a recent brief, Digital Gold: Evaluating a Strategic Bitcoin Reserve for the United States, the Bitcoin Policy Institute also recommends that the United States establish a Bitcoin Strategic Reserve to serve as “a unique complement to traditional monetary reserve assets such as gold and Treasury securities” that will help ensure “continued dollar dominance.”

Why Reserve Assets?

So it’s goodbye Bitcoin, dollar “terminator”; hello Bitcoin, dollar “supercharger”!

Or is it? Arguments suggesting that an official Bitcoin stockpile can strengthen the US dollar are distinct from those that liken Bitcoin to strategic commodities like petroleum and silicon chips or those that would have the US government include Bitcoin in a Sovereign Wealth Fund. Although calls for a Strategic Bitcoin Reserve tend to conflate these different arguments, I’m only concerned here with the “currency reserve” argument. Would having the government stock up on Bitcoin really “supercharge” the dollar? Would a Strategic Bitcoin Reserve serve the same purpose gold reserves serve in the U.S., or anywhere else? Is it even the case that the dollar needs “supercharging” to preserve its global status?

To answer these questions one must understand the general role that non-domestic reserves play in supporting today’s fiat monies, and the US dollar in particular. Official reserve assets consist of financial assets held by fiscal or monetary authorities that can’t be created by those authorities themselves. In practice today that means foreign exchange (foreign currency itself plus foreign-currency-denominated bank deposits and securities) and gold. As of mid-2024, according to the IMF’s reckoning, the world’s monetary and fiscal authorities held $12,347 billion in foreign exchange assets and 29,030 metric tons of gold, worth around $2.2 trillion.

Why do governments hold reserves? In the days of commodity-based monies, both central and commercial banks needed reserves of the money commodity to meet redemption requests of their customers and other banks. When many nations’ monetary systems are based on the same standard commodity, as was the case during the gold-standard era prior to the Great Depression, reserves are also needed to cover international payment deficits, meaning any positive difference between nations’ net foreign capital outflows, exclusive of reserve transfers, and their current account earnings (exports minus imports and net foreign transfer payments).

In today’s irredeemable fiat money systems, reserve assets obviously aren’t needed to redeem either central or commercial bank liabilities. Commercial bank deposits are instead claims to central bank paper currency or, in interbank settlements, central bank reserve credits. Provided they’re willing to let their currencies’ exchange rates vary freely, nations can rely on exchange rate adjustments to eliminate balance of payments deficits instead of having to meet deficits with foreign exchange kept on hand for that purpose.

In practice, however, even nations that issue their own fiat monies often seek to “peg” their currencies’ value to that of another nation’s currency. Small, open economies, for example, often prefer to peg their currency to that of their main trade partner to avoid exposing traders to exchange rate risk. In such cases, foreign exchange once again becomes necessary for meeting the balance of payments deficits. Other countries seek to limit movements in their currencies’ otherwise flexible exchange rates—that is, they prefer “managed” or “dirty” floats to either pegged or freely floating exchange rates. Those countries must also keep stocks of one or more foreign currencies on hand for the purpose.

Gold reserves, on the other hand, no longer serve to settle international accounts. Yet they make up roughly 15 percent of global reserve assets. The main reason for this is that gold is a good hedge against exchange-rate or “currency” risk, meaning the risk monetary authorities incur by holding reserves of foreign exchange. When kept at home, as bullion, rather than with foreign custodians, gold is also free from the political risk to which foreign exchange holdings may be subject, meaning the risk of having foreign exchange consisting of deposits in foreign banks or foreign-government securities frozen or expropriated by foreign governments.

But as we’ll see, a big chunk of the world’s official gold reserves is held for no better reason than sheer inertia. That consists of the 8,133 metric tons of gold—about two-sevenths of the world’s total—held by the United States, almost all of which is left over from a much larger pile the US accumulated during the days when the dollar was still tied to gold.

The US Dollar as a Global Reserve Asset

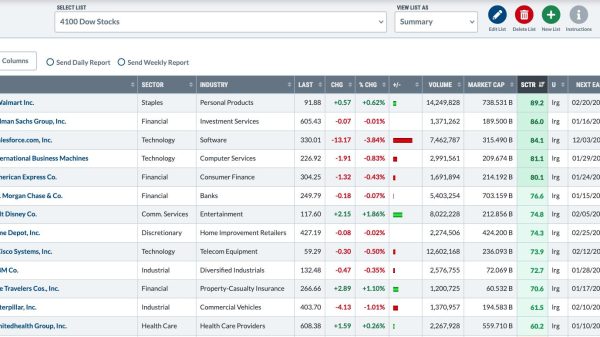

Although global foreign exchange holdings include the currencies of many countries, US dollars lord over the rest, comprising over 58 percent of the total. Euros run a distant second, at 20 percent. As can be seen from the following Federal Reserve chart, a handful of currencies—the Japanese yen, British pound, Australian and Canadian dollars, and Swiss franc—account for most of the rest. Other currencies, if they’re held in reserve at all, are held in insignificant amounts.

The dollar’s dominant role is no mystery. According to a recent Brookings Commentary, dollars are also used in 58 percent of all cross-currency-jurisdiction payments, meaning international payments minus those among Eurozone nations, as well as in most foreign exchange trading. 64 percent of world debt is also denominated in dollars, including some $13 trillion in US dollar credits to nonbank borrowers outside the US. These statistics also explain why so many foreign governments prefer to peg, or at least limit movements in, their currencies’ exchange rates with the US dollar, though doing so obliges them to hold substantial US dollar reserves.

If the dollar’s status is so secure, why are people saying that it needs shoring up? That belief rests upon the fact that since the late 1990s the dollar’s share of total international reserve assets has fallen by a dozen percentage points. Were that decline matched by a corresponding increase in the share made up of euros, yen, or even British pounds—the only other serious contenders for the “dominant currency” crown—and were the shift likely to continue, it might eventually spell trouble for the dollar’s reserve-currency ranking. And were the decline a reflection of a reduced volume of USD-invoiced trade, it might suggest that the dollar is also becoming a less popular medium of exchange. But neither of those things is happening. Instead, the dollar has been losing ground not to the euro or the yen, it’s only serious if still distant rivals, but to various “nontraditional” reserve currencies, including Canadian dollars and Chinese renminbi, and gold. And it is losing not so much because a lot more trade is being invoiced in nontraditional currencies and gold—cross-border renminbi payments, for example, are still dwarfed by USD payments—but for other reasons, including the US government’s “weaponization” of the dollar, meaning its resort to sanctions involving the freezing, if not outright confiscation, of foreign governments’ dollar reserves kept in US financial institutions or in financial institutions in other countries that cooperate with the US authorities.

It should be obvious that building a Strategic Bitcoin Reserve won’t relieve foreign governments of the risk of having their US dollar reserves sequestered. What’s perhaps less obvious is the fact that such a reserve would do nothing at all to shore up the dollar’s value or otherwise enhance its popularity.

U.S. Reserve Assets

As of October 2024, the United States Treasury and Federal Reserve System held $245 billion in reserve assets. Besides foreign exchange (over $37 billion worth, of which roughly two-thirds are Euros and the rest Japanese yen), and those 8,133 metric tons of gold (worth $11,041 million according to gold’s official price of just $42.22 per troy ounce, and about $691 billion at its present market price), this sum includes the United States’ IMF reserve position (not quite $29 billion) and its quota of IMF-created Standard Drawing Rights (SDRs) (a bit under $170 billion).

To judge by this total sum, the United States’ reserve asset stockpile puts it in the minor leagues. Despite being the world’s largest economy, that stockpile is only the world’s 15th largest, behind those of Hong Kong, Singapore, and Italy, among others.

Unimpressive as that raw ranking is, because it takes account of IMF reserves and SDRs, which make up over 80 percent of the United States’ total reserve assets, it greatly exaggerates the importance the US government attaches to those assets. For while the Treasury and Fed together decide how much foreign exchange and gold to have on hand, the United States IMF reserve position and SDR holdings are set by IMF rules. For example, the IMF periodically sets the total SDR allocation for all of its members, which it then parcels out to them according to their quota shares of the Fund.

The United States’ large SDR stockpile mostly reflects the IMF’s recent total allocation of over 660 billion SDRs (worth about $890 billion) and the United States’ hefty IMF quota share of 17.42 percent. The United States’ IMF reserve position is likewise an obligatory amount, representing a portion of each IMF member’s total mandatory contribution to the fund. Ranking nations’ reserve asset holdings after deducting both their SDR holdings and their IMF reserve positions puts the US in 45th place, below Vietnam, Romania, Columbia and Qatar! And as we’ll see, because it depends on the United States’ outsize gold holdings, even this ranking exaggerates the significance of the United States’ international reserve holdings, for unlike the gold held by most central banks, the US gold stock (which, incidentally, belongs not to the Federal Reserve but to the Treasury) serves no strategic purpose.

That the United States’ reserve assets, and particularly its foreign exchange holdings, are so modest is a reflection of the US dollar’s unique status as the freest of free-floating currencies: other governments may tie their currencies to it, whether tightly or loosely; but so far as the United States government is concerned, maintaining those ties has mostly been, and for some time now has exclusively been, those other governments’ problem.

That the US government can generally afford to let its currency float is one aspect of the “exorbitant privilege” it enjoys as a result of the dollar’s status as both a national and a global exchange medium. As I’ve noted, about 58 percent of all international trade is invoiced in dollars, and dollars make up a corresponding share of official global foreign exchange holdings. A number of countries besides the United States use actual US dollars as their domestic currency. The worldwide demand for dollars, both official and private, makes it unnecessary for the United States government to borrow in other currencies, while the dollar’s free-floating status rules out any need for foreign currency to settle U.S. payments imbalances.

The Exchange Stabilization Fund: A Poor Precedent

The status of the US dollar means that it really isn’t necessary for the US government to hold foreign exchange at all. Since the collapse of the Bretton-Woods System in 1973, the United States hasn’t been under any obligation to take part in the maintenance of any international fixed exchange rate arrangement. And while the Federal Reserve has long been authorized to buy and sell foreign exchange, its mandate, as set forth in the Federal Reserve Act, calls for it to promote “maximum employment, stable prices, and moderate long-term interest rates,” but says nothing about stabilizing or otherwise regulating exchange rates.

Even before the collapse of Bretton Woods, responsibility for US exchange rate policy has mainly rested with the US Treasury rather than the Fed, with the Fed assisting the Treasury’s efforts in its capacity as its fiscal agent. (The traditionally joint nature of Treasury-Fed exchange market operations is reflected in the roughly equal division of the nation’s foreign exchange reserves between the two.) This arrangement dates from the January 1934 passage of the Gold Reserve Act, which called for the Fed to surrender its gold reserves to the Treasury in exchange for gold “certificates” in anticipation of gold’s official revaluation from $20.67 per fine troy ounce to $35 per ounce, which continued to be gold’s official price until December 1972, when it was raised to $38. (Some months later it was raised again, to its current level of $42.22 per fine troy ounce.) Of the $2.8 billion nominal profit the Treasury gained by this exchange, $2 billion went to establish an “Exchange Stabilization Fund” (ESF) “for the purpose of stabilizing the exchange value of the US dollar.” Importantly, instead of being subject to the congressional appropriations process, or to any sort of congressional scrutiny, the ESF was to be self-financing and under the exclusive control of the Secretary of the Treasury.

In Digital Gold, the Bitcoin Policy Institute rests its case for a Strategic Bitcoin Reserve partly on the precedent set by the ESF. “The ESF,” it says, “provides the US Treasury with a tool to stabilize currency markets during periods of exchange rate volatility, helping to ensure that the US dollar maintains its value relative to other currencies. This enables the US to intervene in foreign exchange markets, mitigate speculative attacks, and prevent sharp devaluations or appreciations that could disrupt trade balances or financial stability.”

But while the ESF was indeed established for the purpose of “stabilizing the exchange value of the dollar,” its exchange market interventions, almost always undertaken jointly with the Fed, have been quite limited since 1995, and it hasn’t intervened at all since March 2011. Why not? First, as we’ve seen, foreign exchange operations haven’t been necessary since the dollar was set afloat in March 1973—a fact officially (if belatedly) recognized by legislation enacted in 1976 that struck out the Gold Reserve Act’s reference to stabilizing the dollar’s value and instead made the ESF responsible for undertaking whatever operations the Treasury Secretary deemed “necessary to and consistent with the United States obligations in the International Monetary Fund.”

Although, as the FRED chart below shows, the ESF took advantage of its new—and much vaguer—mandate to intervene frequently in foreign exchange markets between the late 1970s and the mid-1990s, after 1980 its interventions were, more often than not, aimed at weakening rather than strengthening the dollar. But whether they had any lasting effect on the dollar’s exchange value is doubtful, both because the interventions were too mall relative to the sizes of the markets involved to have mattered much, and because even large-scale interventions could only have a lasting effect if the Federal Reserve allowed the Treasury’s exchange-rate goals to dictate the overall course of monetary policy.

And the Fed did no such thing. Instead, its determination to clamp down on inflation during the 1980s ruled out any such subservience. So it happened that, by the 1990s, the US government’s exchange rate interventions were mainly undertaken “out of a spirit of cooperation” with other governments, as when the US intervened to satisfy its part in the Plaza and Louvre Accords of 1985 and 1987, rather than in pursuit of any of US government exchange-rate targets.

Since the mid-1990s, even such “cooperative” interventions have been rare: the US intervened to support the yen in 1998, to support the Euro in 2000, and to stabilize the yen following Japan’s 2011 earthquake and tsunami. But it hasn’t intervened since. In 2013 the United States took part in an agreement among the G7 nations to devote their monetary and fiscal policies to meeting domestic policy objectives instead of targeting exchange rates, and today it seems less likely than ever to change its mind. Far from serving any strategic purpose, the United States’ present foreign exchange holdings are mere leftovers from its earlier interventions.

Despite what one might expect, these developments haven’t caused the ESF—which seems to have more lives than a cat—to give up the ghost. Long before it gave up trying to influence the dollar’s exchange rate with other major currencies, the Treasury found another use for it, namely aiding less developed nations, particularly in Latin America.

The ESF’s constitution, its vague post-Bretton-Woods mandate, and its ability to “monetize” its SDR and FX holdings (that is, to have them temporarily converted into US dollars at short notice), allow it to make substantial emergency short-term loans without congressional approval. By the 1990s such lending had become the ESF’s principal undertaking. Because the ESF typically made loans by temporarily “swapping” US dollars for foreign currency, they qualified as foreign exchange operations. But stabilizing exchange rates wasn’t their main purpose, and in many cases wasn’t their purpose at all.

That Congress should have taken a dim view of the Treasury’s use of the ESF as a source of “backdoor” foreign aid is hardly surprising. Matters came to a head in 1995 when Bill Clinton used the ESF to finance a $20 billion Mexican aid package. Afterward, Congress tried but failed to substantially reduce the ESF’s capacity to fund foreign governments. But the public outcry raised by the Mexican intervention was itself enough to convince the Treasury to avoid any further, substantial use of the ESF for foreign loans. So the fund died yet again. And yet again it lived, for the Treasury found still another use for it, namely as a source of rapidly mobilized funds to deal with domestic emergencies. In 2008 it was used to insure money market fund balances, and during the COVID-19 crisis it was used both to backstop the Federal Reserve’s risky emergency lending programs and to finance the CARES Act. Inspired by these examples, the Bitcoin Policy Institute has suggested using the ESF to fund its proposed Strategic Bitcoin Reserve.

Needless to say, an ESF that serves mainly as a rapid-fire way to pay for domestic rescue operations, or to occasionally purchase Bitcoin, or oriental carpets, or Japanese real estate, doesn’t need to stockpile foreign exchange. And an agency that has no need for foreign exchange also doesn’t have to hedge against the risks that go hand-in-hand with holding on to substantial amounts of foreign exchange. If the US government wants to avoid losing money on its foreign exchange holdings, the sensible way for it to do so is by disposing of those holdings, gradually or otherwise, not by accumulating some other risky asset.

A Golden Relic

If the United States government has no need for foreign exchange, what, if any, need has it for gold? According to the Bitcoin Policy Institute, besides having “historically…been an important part of US global financial strategy, supporting confidence in the dollar and serving as a hedge against inflation or currency crises,” the US gold stockpile serves “as a last resort financial asset that can be quickly re-monetized in extreme circumstances, providing the US with a historically reliable source of liquidity to address severe financial or geopolitical challenges that disrupt the global monetary order.” Finally, gold reserves allow the government “to subtly influence precious metal markets, ensuring price stability during periods of significant monetary or geopolitical upheaval.”

To each of these claims regarding the benefits of the United States’ gold stock there’s an obvious riposte. Concerning supporting the dollar: “historically” is doing all the lifting: the dollar’s value hasn’t depended on the Treasury’s gold holdings since 1971 when it became inconvertible fiat money. (The value of a free-floating fiat currency, like the value of Bitcoin, is a function of the real demand for it and the quantity supplied, not the assets its creators possess). Concerning gold’s liquidity: nothing is more “liquid” than dollars themselves, which the US can create without it. Concerning helping precious metal markets: here, for once, is something a gold stockpile does. But then the question becomes, what reason is there for the government to prop up the gold market, other than to enrich gold miners and investors at others’ expense?

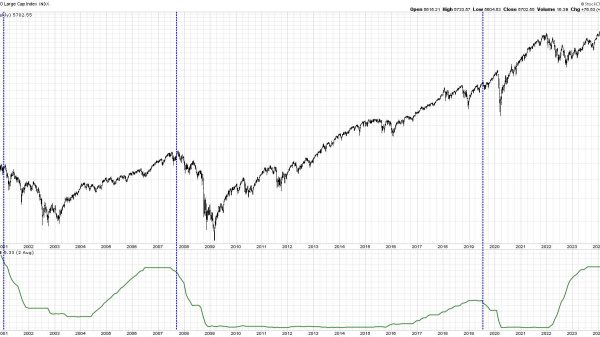

Far from having been deliberately acquired to serve some strategic purpose, the Treasury’s current gold stock is a legacy of the days, subsequent to the dollar’s devaluation in January 1934, when the US was perceived as a uniquely safe haven for the precious metal. As the FRED chart below shows, between the passage of the Gold Reserve Act and the 1950s the US gold stockpile grew more than six-fold—passively, if not to officials’ dismay—to a peak of more than 20,000 metric tons. During the 1950s, and especially after the Bretton-Woods System became operational in 1958, the flow reversed.

When Nixon closed the gold window in August 1971, the US gold stock was under 8,700 metric tons. Since then, despite serving no obvious purpose, it has changed very little. Yet no statute keeps the Treasury from auctioning off its gold, provided that it redeems a corresponding nominal value of gold certificates held by the Fed. In fact, the Treasury has sold some gold, including about 491 metric tons it disposed of during the late 1970s to take advantage of gold’s then-record price. But when, in June 2011, some proposed selling more to get around that year’s debt-ceiling crisis, the FOMC threw cold water on the plan saying it might disturb not only the gold market but “broader financial markets.” Similar considerations appear to have kept the US government from selling gold ever since.

Who Needs Another Unnecessary Reserve Asset?

While the US government has resisted reducing its gold stockpile, it has never entertained the idea of adding to it. After all, if the 8,133-plus tons of gold now kept in deep storage in Fort Knox and elsewhere is merely a vestige of the gold-standard and Bretton-Woods days, proposing that the US acquire more gold is like proposing that, because they have coccyxes, human beings would benefit by growing tails.

So what about a Strategic Bitcoin Reserve? If there’s no reason save inertia for the government’s vast gold stockpile, there’s no reason at all for it to acquire Bitcoin. (A “second-best” argument for having it do so—that adding Bitcoin to its portfolio might lower the risk associated with those gold holdings—founders on the fact that Bitcoin isn’t a particularly good gold hedge.) No reason, that is, unless it’s “to [not so] subtly influence the market” for that virtual precious metal, specifically by driving up its price.

And—let’s be honest—although some Bitcoin fans may sincerely believe that a Strategic Bitcoin Reserve will strengthen the US dollar, many more favor it despite not caring a fig about the dollar’s future because they expect it to make them richer, and don’t mind if it does so at others’ expense.